Customers gathered in front of the Aden branch of the International Bank of Yemen, demanding to withdraw their deposits, June 10, 2024 (South24 Center)

27-04-2025 الساعة 12 مساءً بتوقيت عدن

|

|

“The Central Bank should take decisive measures, including seizing and selling the assets of the International Bank of Yemen as well as the properties of its executives, in order to utilize the proceeds”.

Abdullah Al-Shadli (South24)

Amid a turbulent political, economic, and banking landscape, thousands of depositors now find themselves at the center of an unprecedented crisis which threatens their personal savings, with the Houthi-controlled banks in Sanaa becoming a direct target of US sanctions.

With the US decision to impose strict sanctions on commercial banks, including the ’International Bank of Yemen‘ and the ’Yemen Kuwait Bank‘, accusing them of facilitating financial transactions in favor of the Houthis, the customers’ concerns are mounting as access to funds, especially in US dollars, is becoming increasingly difficult amid the lack of liquidity and freezing of these banks’ assets.

Even before the sanctions, these banks, especially the ‘International Bank of Yemen’, had refused to return their customers and depositors’ funds citing the pretext of lack of financial liquidity The ‘International Bank of Yemen’ has served as the main gateway for receiving international assistance delivered to Yemen as well as the accounts of UN agencies and humanitarian and aid organizations.

With the division of the banking system in the country and the presence of two central banks - one internationally-recognized and based in Aden, while the second is controlled by the Houthis and based in Sanaa, questions are mounting over who would bear responsibility for guaranteeing the depositors’ funds in the two sanctioned banks, or in any other bank that may be sanctioned by the US in the coming days.

The US Sanctions

On January 17, 2025, the US Department of the Treasury’s Office of Foreign Assets Control (OFAC) imposed sanctions on the Yemen Kuwait Bank, the oldest commercial private bank in Yemen, for its financial support to the Houthis. According to its statement: "The Houthis rely on a few major financial institutions such as the Bank of Yemen and Kuwait to access the international financial system and fund their destabilizing attacks in the region. The United States is committed to disrupting these illicit channels and working with Yemen's internationally recognized government to ensure that the country's banking sector remains insulated from Houthi influence.”

The statement said the ”Yemen Kuwait Bank aids the Houthis in exploiting the Yemeni banking sector to launder money and transfer funds to its allies, including Lebanese Hizballah. Yemen Kuwait Bank has helped the Houthis establish and finance front companies, which the group has used to facilitate Iranian oil sales in coordination with sanctioned Houthi-associated money exchange Swaid and Sons for Exchange Co.” It stressed that “Senior Houthi officials, including Hashem Ismail Ali Ahmad al-Madani, the sanctioned governor of the Houthi-aligned central bank in Sanaa, have played key roles in transferring funds to the Houthis from the Islamic Revolutionary Guard Corps-Qods Force (IRGC-QF).” For its part, the Yemen Kuwait Bank has denied the accusations, and claimed that the sanctions are related to the ongoing escalation between the United States and the Houthis. The bank emphasized that its local operations are continuing, and the impact of sanctions is limited to its international operations.

On March 4, the US State Department announced the redesignation of the Houthis as a ’Foreign Terrorist Organization‘(FTO), based on the Executive Order 14175 signed by US President Donald Trump on January 22, at the beginning of his second presidential term.

On April 17, the US Department of Treasury’s OFAC imposed sanctions on the ’International Bank of Yemen‘ and three of its senior leaders, accusing the bank of playing a “critical role” in helping the Houthis “access the international financial system and threaten both the region and international commerce”. The OFAC also sanctioned key leaders or officials of IBY, Kamal Hussain Al Jebry, Ahmed Thabit Noman Al-Absi, and Abdulkader Ali Bazara.

The statement said the International Bank of Yemen, based in Sanaa, “is controlled by the Iran-backed Houthis and provides the terrorist group access to the bank’s Society for Worldwide Interbank Financial Telecommunications (SWIFT) network to make international financial transactions”. It said the bank facilitated the Houthis’ oil purchases via SWIFT and also “facilitated attempts by the Houthis to evade sanctions oversight, and has helped the Houthis to mobilize resources and confiscate assets from Houthi opponents.”

It added that the International Bank of Yemen refused to comply with requests by the Central Bank of Yemen-Aden for information “to avoid revealing the details of these Houthi confiscations”. It said that after the FTO designation of the Houthis, the Central Bank in Aden worked with banks in Houthi-controlled areas to move their operations to Aden “far from the intimidation and coercive influence of the Houthis”.

However, the IBY refused to move its headquarters from Houthi-controlled territory.

The US Department of Treasury stressed that it “remains committed to working with the internationally recognized government of Yemen to disrupt the Houthis’ ability to secure funds and procure key components for their destabilizing attacks.”

In a statement on April 19, the International Bank of Yemen said that the sanctions on it and three of its officials are linked to “political reasons in Yemen”. The bank claimed that it is committed to anti-money laundering and counter-terrorism financing standards as well as the laws of the Central Bank of Yemen.

Earlier, in May 2024, the Central Bank of Yemen-Aden had imposed sanctions on the International Bank of Yemen and the Yemen Kuwait Bank, as well as four other banks headquartered in Sanaa, after their failure to comply with a two-month deadline set by CBY to relocate their headquarters to Aden.

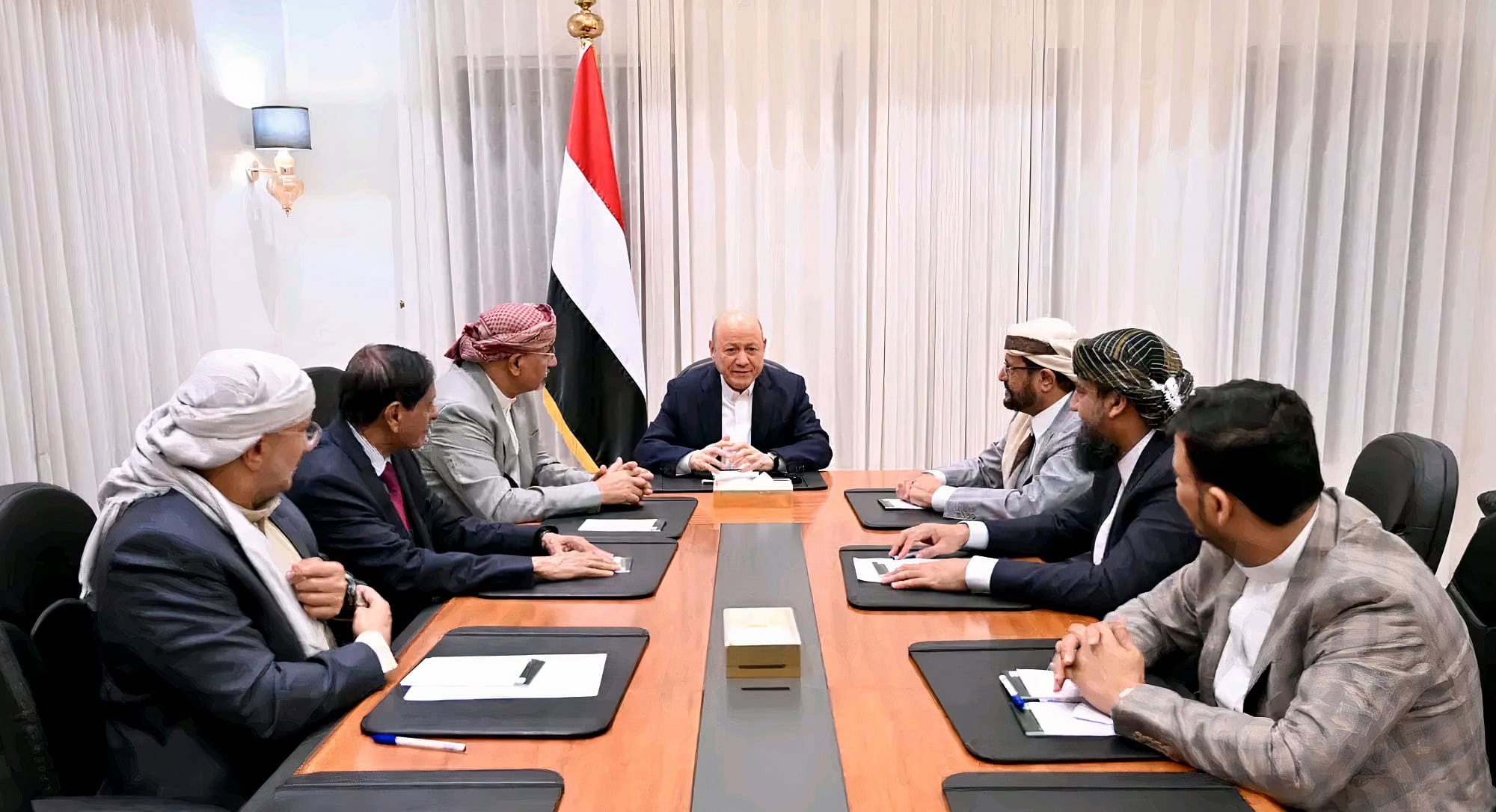

However, in July 2024, the CBY-Aden reversed these measures following pressure on the Presidential Leadership Council (PLC) by Saudi Arabia and the UN Envoy to Yemen, an informed source told ’South24 Center‘. These pressures aimed to avoid economic escalation with the Houthis, who had already begun implementing counter economic measures and banned Southern banks operating from Aden.

With the Houthis being re-designated as FTO, and the US’ tough measures on the group, including launching fierce attacks on Houth areas in North Yemen, the Central Bank of Yemen-Aden’s position has been strengthened.

On March 15, 2025, the CBY-Aden announced that it has received written notifications from the “majority” of banks in Sanaa stating their decision to relocate their headquarters to Aden “to avoid falling under the strict sanctions imposed by the United States”.

So far, the CBY-Aden hasn’t provided any updates about whether the relocation of headquarters from Sanaa to Aden has begun. In addition, no bank has made any official announcement regarding this move.

’South24 Center‘ tried to contact the leadership of CBY-Aden to ask about this issue as well as other inquiries related to the sanctioned banks and the depositors' funds, but we haven’t received a response so far.

Concerns about the Depositors’ Funds

The situation of the Sanaa-based banks, particularly those sanctioned by the US, has raised significant concerns about the fate of depositors’ funds. These concerns aren’t unfounded as customers and depositors of the International Bank of Yemen have unsuccessfully attempted to withdraw their funds from the bank’s branches in Aden and other governorates over the past months.

’South24 Center‘ interviewed a customer who has failed to withdraw the equivalent of $4,000 from his account in the International Bank of Yemen since May 2024. The bank cited lack of liquidity as an excuse. On June 10 last year, dozens of angry customers had gathered in front of the bank’s gate after failing to get their money.

Moustafa Nasr, Chairman of the Studies and Economic Media Center, told ’South24 Center‘ that “banks are legally and morally obligated to return the deposits to their owners, as these rights aren’t waived and must be fulfilled”.

Nasr emphasized that “the CBY is primarily responsible for guaranteeing the rights of depositors, especially its branch in Sanaa. The latter branch controls these banks and holds substantial balances deposited as treasury bills and mandatory cash reserves, which are meant to safeguard the rights of depositors”.

Regarding the situation of Yemen Kuwait Bank, Nasr said: “Based on my observations, the bank has worked to fulfil a large portion of its commitments to depositors who want to withdraw their money locally.” He added: “However, the bank will be negatively impacted with regard to its international transactions due to the sanctions imposed on it.”

With regard to the situation of the International Bank of Yemen, the expert, Moustafa Nasr, described it as “different and more complicated”. He pointed out that the bank is "almost bankrupt, and it has long been evident that the bank is unable to meet the needs of its depositors”.

Nasr stressed that the “CBY should take decisive measures, including seizing and selling the assets of the International Bank of Yemen and the properties of its executives and use the proceeds, in addition to the mandatory cash reserves that the CBY is supposed to hold, to fulfill the bank's obligation to depositors and compensate them”.

Dr. Mohammed Jamal Al-Shuaibi, Professor of Political Economy at the University of Aden, believes that “this issue has become complicated and requires unconventional solutions”. He pointed out that the International Bank of Yemen, for example, has invested a significant portion of its assets in treasury bills and local public debt, which were deposited with the CBY-Sanaa.

He told ’South24 Center‘ that “the Houthi control over CBY-Sanaa, along with seizure of the banks’ balances, cash reserves, and public debt funds, has led to freezing the liquidity of the International Bank of Yemen and other banks”.

As a result, Al-Shuaibi believes that the CBY-Sanaa has become incapable of meeting its obligations to commercial banks, including the International Bank of Yemen, which is facing difficulties in returning depositors’ funds, since a large portion of the funds is frozen at the Central Bank in Sanaa.

Regarding the responsibility for recovering the funds, he said: “Given the current circumstances, the issue appears primarily political. The recovery of depositors' funds hinges on arriving at a political and economic understanding.”

He added: "The possible solutions could include reaching a political settlement that allows for the restoration of the looted funds, seeking external compensation mechanisms or at least recovering the assets frozen and controlled by the de-facto authority in Sanaa.”

Nonetheless, the International Bank of Yemen, in its statement of April 19, claimed that it guarantees the balances of its depositors and customers. It claimed that its assets exceeded the rights of depositors and shareholders, and added that it will continue to provide its local banking services “under these difficult conditions which are out of its control”. The bank vowed to take measures to prevent or reduce the negative impacts.

The bank said “it will take all necessary steps to coordinate with the United States through official and legal channels to reverse these sanctions as soon as possible”.

Escaping US Sanctions

Expert Moustafa Nasr draws a connection between the intention of some commercial banks to relocate their main operations from Sanaa to Aden and their desire to avoid the US sanctions.

He pointed out that “any bank maintaining its main financial center in areas under Houthi control will be vulnerable to accusations that it is involved in operations that serve the interests of the Iran-backed group or contributes to its financing. This could make it a potential target for future sanctions”.

Nasr warned that the banks that haven’t so far relocated their main operations to government-controlled areas risk “being subjected to US sanctions”. He urged them to “take this step quickly to protect themselves, their customers, and the national economy from grave risks similar to what happened with other banks”.

Dr. Mohammed Jamal Al-Shuaibi explained the problems faced by Yemeni banks that seek to relocate their headquarters from Sanaa to Aden. He pointed out that the most prominent reason is the Houthis' choking control over the banking sector in the North and their threats to banks attempting to comply with the CBY-Aden’s directive.

Furthermore, banks fear losing their significant market share in North Yemen which represents more than 65% of the Yemeni market and 80% of the commercial banks’ activities.

Al-Shuaibi pointed out that full relocation to Aden would mean losing these markets in a way that may lead to the collapse of some banks that have invested heavily in local public debt tools which are under the control of the Houthis.

With regard to the international remittance networks in the Houthi-held areas, Al-Shuaibi pointed out that “the continuous operation of networks like Western Union in Houthi-held areas serves as an additional attraction factor for banks to remain in North Yemen”.

As for the US sanctions, Al-Shuaibi believes that they will strengthen the role of Aden as an international financial hub in return for isolating Sanaa in a parallel economy.

The impact of the sanctions on the Houthi economy include “financial blockade, international isolation of the targeted banks, complications in the export of basic commodities due to the inability to open credits, and increasing pressure on the Houthis as a result of the potential collapse of liquidity and due to the withdrawal of deposits from some banks in their areas”.

According to Al-Shuaibi, the banks that would be subjected to future sanctions are primarily the ones that refuse to comply with CBY-Aden’s directive to relocate their headquarters from Sana, as well as those banks that are involved in supporting the Houthis financially (through money laundering, funding activities) and the banks that ignore the other instructions of CBY-Aden.

Al-Shuaibi cited some likely examples, including ’Sabaa Bank‘, ‘Tadhamon Bank‘, ’Alamal Bank‘, ’Yemen Bank for Construction and Development‘, and the branches of ’Kurami Bank’.

The escalating crisis surrounding the sanctioned banks in Sanaa highlights the extent of institutional vacuum and weak oversight in the Yemeni banking sector, especially in the Houthi-held areas. While external punitive measures continue, the rights of civilian depositors, who have nothing to do with the conflict, remain at risk due to the absence of legal protection and the conflict in the monetary decision-making authority.

Without implementing urgent and decisive measures that prioritize the protection of people’s money, it appears that trust in the banking sector will continue to erode, leading to mass deposit withdrawals, a deeper economic shrinkage, and the expansion of the unofficial economy.

قبل 3 أشهر

قبل 3 أشهر

قبل 3 أشهر