The Port of Aden’s Container Terminal amid unloading and handling activities through the port's quays and container storage yards. February 8, 2024 (Yemen Gulf of Aden Ports Corporation on Facebook-The Port of Aden)

21-04-2025 at 1 PM Aden Time

|

|

The future of Aden as a hub port isn’t only linked to the decline of Hodeidah’s role but is also related to the extent the relevant parties are able to overcome security, institutional, and economic obstacles.

Abdullah Al-Shadli (South24)

On January 10, 2025, a series of Israeli airstrikes targeted the ports of Hodeidah controlled by the Houthis in Yemen. These airstrikes were in response to drone and missile attacks launched by the Iran-allied group against Israel. They were the latest among a series of violent Israeli attacks targeting the ports of Hodeidah, which were first attacked in July 2024 and in December too.

Israeli raids on the Port of Hodeidah on July 20, 2024 (The Houthi media center via France Press)

On April 4, less than three months after the January attack, the United States imposed a ban on fuel imports through the Port of Hodeidah. This has constituted a new chapter in the pressure campaign against the Houthis who are officially designated by the US as a Foreign Terrorist Organization (FTO). This measure was preceded on March 15 by unprecedented US airstrikes on Houthi-linked sites in Sanaa, Hodeidah, and other governorates in North Yemen in response to the group’s attacks against international navigation in the Red Sea.

In a statement on banning fuel imports via the Port of Hodeidah, the US State Department said that “the United States is committed to obstruct the Houthi activities and restore the freedom of navigation in the Red Sea”. The US officials warned that providing any form of material support to the Houthis, including oil shipments, will be considered a violation of the US law.

However, the implementation has been uneven. On April 7, three days after the ban came into effect, the United Nations Verification and Inspection Mechanism (UNVIM) for Djibouti allowed a fuel tanker to dock in Ras Issa. This step has stirred doubts among analysts regarding the effectiveness of sanctions in the short term. This also raises questions about the opportunities provided by these developments to enhance the importance of the strategic Port of Aden in South Yemen, controlled by the Internationally-Recognized Government.

The Implications of Airstrikes

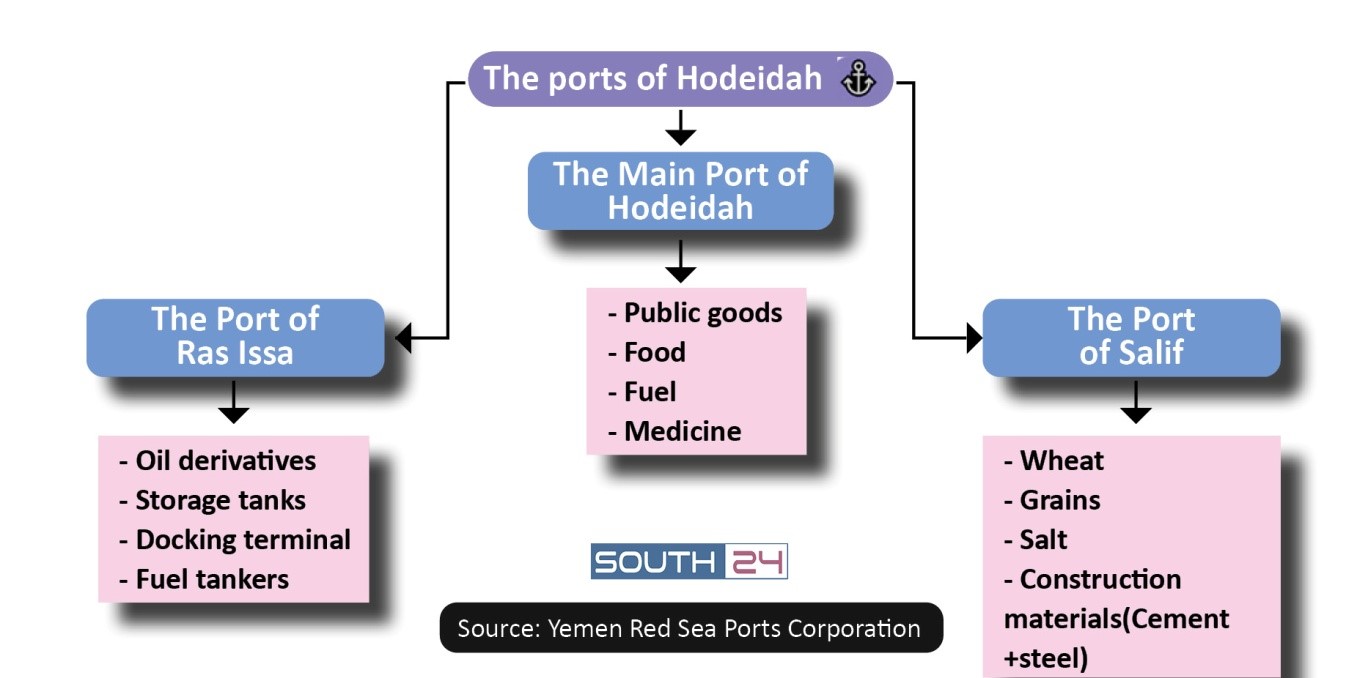

The governorate of Hodeidah on the Red Sea coast has three main ports which play integrated roles in securing supplies for North Yemen. They include the main Port of Hodeidah, the Port of Ras Issa, and the Port of Salif.

The main Port of Hodeidah (Google Maps-cropped by ‘South24 Center’)

The main Port of Hodeidah is considered the most important among these ports. It is located in the center of the city and receives the commercial ships loaded with food, medicine, public goods, and fuel. This port serves as a vital lifeline for the Houthi-held areas and is under the control of the UNVIM.

The oil Port of Ras Issa is located in the north of Hodeidah. It is basically used for importing and storing oil derivatives. Previously, it was used for exporting crude oil from Marib's fields through the Safer company by making use of its huge tanks. However, the port currently serves as the main station to unload fuel coming to the Houthi areas.

On the other hand, the Port of Salif, located in the northwest of Hodeidah, is used for importing bulk cargo such as wheat, grains, and salt. It is characterized by its deep quays which allow receiving big vessels. It is sometimes used to import construction materials such as cement and steel. It serves as an alternative to the Port of Hodeidah to reduce pressure on it.

The Port of Hodeidah has been a vital lifeline for North Yemen. However, it currently suffers from operational collapse. The repeated airstrikes and the growing insurance costs have reduced its operational capacity by 70 percent, according to data released by Reliefweb on January 18, 2025, even before the latest US airstrikes and sanctions. This means that the current situation may be worse.

Informed sources told ‘South24 Center’ that the Israeli airstrikes caused direct damage to cranes, depots, and logistic corridors, crippling the key infrastructure in Hodeidah. But the indirect damage may be more debilitating as the global shipping companies are now increasingly hesitant to dock in the Port of Hodeidah due to the growing insurance risks and its falling reputation.

Furthermore, the ports of Ras Issa and Salif are also damaged due to the Israeli airstrike of December 2024. Previously, the Yemeni government had accused the Houthis of using the Port of Hodeidah to receive weapon shipments from Iran. This is likely the reason behind the Israeli and American bombing raids.

The Capabilities of the Port of Aden

The Port of Aden is considered one of the most important strategic ports in the region and at the level of the Arabian Sea due to its distinctive geographical location at the crossroads of global trade routes between Asia, Africa and Europe.

The port is a main crossing point for ships heading to the Suez Canal and the Horn of Africa. Its major advantages are its free zone and modern container terminal, besides having several quays used for receiving public goods, fuel, and containers. It was previously one of the most active ports in the region thanks to its technical capabilities and connection to the international maritime transport network.

The Container Terminal in the Port of Aden (Google Maps-cropped by South24 Center)

Despite the growing security threats facing the Yemeni shipping lanes, the Port of Aden remains a potential alternative to the Port of Hodeidah, subject to realizing certain conditions. Abdulrab Al-khulaqui, Deputy Executive Director of the Yemen Gulf of Aden Ports Corporation, told ‘South24 Center’ that “the port needs huge and long-term investments in fixed assets and infrastructure”, the lack of which has led to its slow adaptation to the rapid global transformations in this sphere.

However, Al-khulaqui remains optimistic about the current capacity of the Port of Aden. He added that “the port is completely capable of absorbing the trade volumes diverted from the Port of Hodeidah as it had done in previous years”.

Business leaders share this optimism, but they emphasize that the revival of the Port of Aden has to be based on organized planning and international partnerships. Abubakr Baobeid, Deputy Chairman of the Federation of Yemen Chambers of Commerce and Industry and Chairman of the Aden Chamber, said that “Aden port is the locomotive of the city's economy as confirmed by all previous economic studies”.

He told ‘South24 Center’ that “there is a need for a comprehensive main plan including the participation of the private sector and reliable development partners. Without international partnership, these efforts will remain limited”.

Al-khulaqui stressed that the Aden Ports Corporation has already started contacting investors regarding upgrading the infrastructure, developing data systems, and rehabilitating assets, in cooperation with the UNDP.

Nonetheless, attracting global companies is still a challenging job in light of the Yemeni economic crisis. Al-khulaqui said: “We are aware of the challenges facing foreign companies, but we are working to create a proper investment environment. With the improvement in political and economic circumstances, Aden can become a regional commercial hub.”

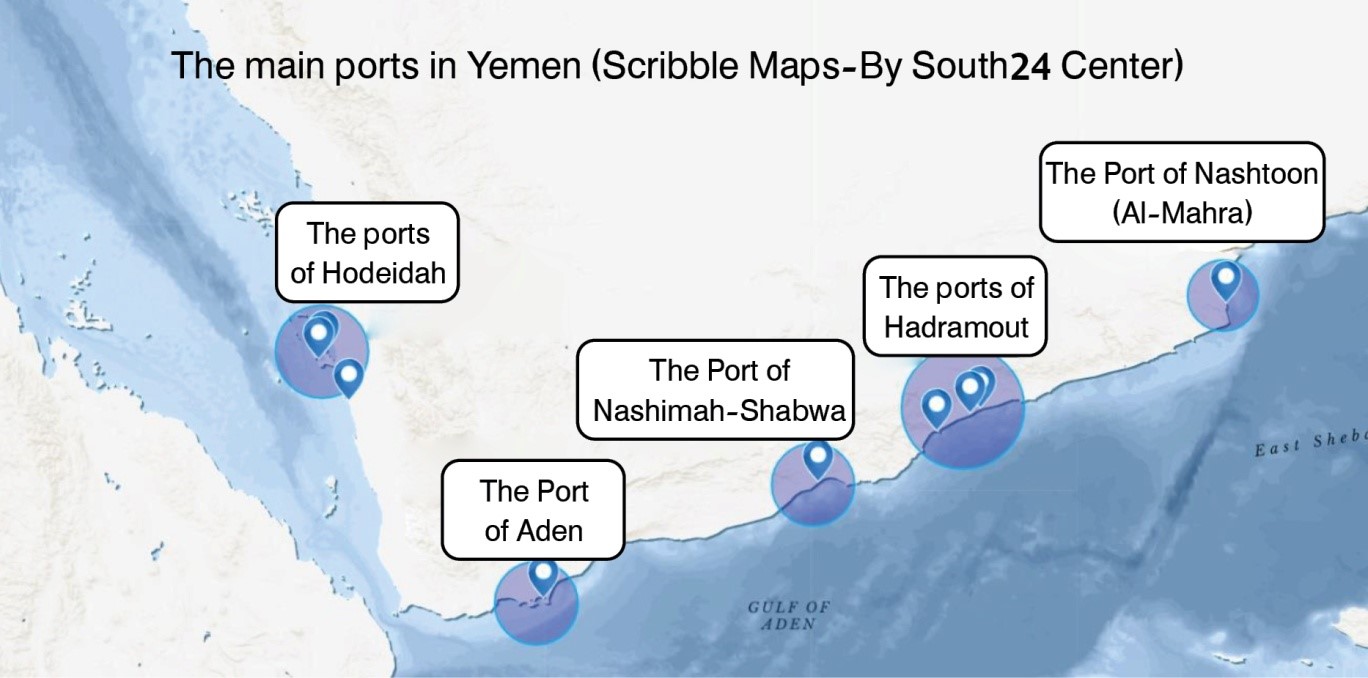

Experts who spoke to ‘South24 Center’ agreed that the lack of decisive action may lead to the port getting sidelined. Furthermore, the success of the Port of Aden could extend to other ports in South Yemen such as the Port of Mukalla and those in Shabwa and Al-Mahra. Previous reports by ‘South24 Center’ have revealed a decline in the performance of the ports of Aden and Mukalla in favor of the Port of Hodeidah over the past years after Saudi Arabia allowed resumption of exports to the Ports of Hodeidah without restrictions.

The Port of Mukalla in Hadramout (Google Maps-cropped by ‘South24 Center’)

Related: How has Mukalla port activity declined after the opening of Hodeidah port?

Related: Between Aden and Hodeidah: What is the reality of commercial maritime traffic?

Challenges

However, this strategic transformation isn't without obstacles. Maritime legal expert Dr. Ayan Ralbi, Chief Executive of IR Consilium, told ‘South24 Center’ that there are at least three key challenges to using Aden instead of Hodeidah.

He detailed: “The first challenge is the terrestrial infrastructure for moving goods to the North and southern coastal areas which are either undeveloped or politically fragmented. The arrival of a shipment to Aden doesn’t ensure that it will reach its final destination.”

The second challenge, according to the expert, is the ongoing rising security threats. “An increase in the use of Aden may invite Houthi retaliatory attacks, which would shift the maritime security threat scenario from the Red Sea to the Gulf of Aden and diminish the use of the Port of Aden as a safe alternative.”

Thirdly, Ralbi pointed to the Houthis’ advantage in the information war, adding that “they depict their rivals as aggressors. If they focus on ships heading to Aden, they may put the reputation of global shipping companies at risk.”

These challenges indicate that despite its advantageous geographical and political location, Aden port needs coordinated logistic, diplomatic, and security support to achieve an effective operational position.

The geopolitical turmoil in the Red Sea has opened a rare opportunity for Aden to reposition itself as a logistic hub. Baobeid believes that this opportunity is no longer an ambition but a national necessity. He emphasized that “the revival of Aden is no longer a matter of ambition but a national duty in light of the economic deterioration in Yemen”.

He described the daily challenges of the private sector, saying: “The illegal fees, the collapse in the value of the local currency, and the decline in purchasing power are factors which are crippling commercial activities”.

However, he believes that there is an opportunity within this crisis. “Despite the adverse circumstances, they have created a narrow, but vital, opportunity for Aden to regain its position among the global trading routes if we act decisively.”

Baobeid also pointed to the poor performance of institutions in Aden and the absence of government officials. He stressed that “the administrative vacuum has pushed private companies to reduce their activities or leave the country. This is a dangerous indicator of the investment climate”.

He highlighted the rise in the maritime insurance costs due to Yemen’s classification as a war zone, adding, “this significantly increases the costs of exports and imports and dissuades ships from considering Aden as a suitable port”.

One of the major challenges is the customs duties imposed by the Houthis at land crossings between areas under their control and government areas on goods imported through the port of Aden. This increases prices, making traders prefer using the Port of Hodeidah to escape the Houthi levies. Moreover, areas held by the militia are where the main populace resides and constitute the largest percentage of the consumer market.

The Revival of the Port of Aden

To benefit from the current strategic opportunity, The Yemen Gulf of Aden Ports Corporation unveiled a comprehensive work plan with an aim to turn Aden into a regional logistic hub.

Al-khulaqui said that the port's priorities include purchasing a new marine tugboat, upgrading its container handling equipment, and rehabilitation of the entrances to the Maalla Port and the Container Terminal – projects that require significant funding and would take 12 to 18 months to implement.

This plan was drafted in May 2024 at the request of the Yemeni Presidential Leadership Council (PLC). It outlines a roadmap to streamline trade, mitigate pressure on the private sector, and improve durability of the infrastructure.

The plan includes a matrix of more than 30 recommendations to be implemented by state ministers, financial institutions, and regulatory bodies. The main measures include the following items:

● Reopening the vital transport crossings (Such as the Dhalea-Taiz Road) to link the Southern ports to Central and Northern markets.

● Removing the illegal security checkpoints and fees imposed by military units and local authorities.

● Unifying the security entities under the government’s authority.

● Limiting the currency fluctuations by empowering the Central Bank and the Ministry of Finance to stabilize the exchange rate of the riyal and support importers with hard currency.

● Upgrading the coast guards’ operations and resuming services of the oil refinery in Aden.

● Encouraging foreign investment by facilitating customs policies, providing incentives, and signing partnerships with global logistic companies.

Other items include unifying the port fees in the governorates controlled by the government, boosting digital systems (port window), and resuming operations of idle assets such as shipyards and oil distribution stations.

Main ports in Yemen (Scribblemaps—by South24)

A noteworthy proposal is to deposit $50 million into an insurance fund to reduce shipping costs associated with Yemen's classification as a war zone.

Additional measures include focusing on reviving local industries and exports through financial incentives as well as pressuring the United Nations to move its operations in Yemen from Sanaa to Aden to enhance the city’s international stature.

Al-khulaqui emphasized that reforms require more than just planning but political will and multilateral coordination. He said: “We have completed the diagnosis, but what remains is the implementation. We are working within a narrow time frame.”

In summary, it can be said that in light of the operational collapse of the ports of Hodeidah and the growing international pressure on the Houthis, the Port of Aden finds itself at a pivotal moment that can restore it as a logistic hub serving the country and the region. However, in order to turn this opportunity into a reality would require more than just anticipation. It is necessary to make multi-level coordination including enacting serious governmental reforms, providing effective incentives to the private sector, and garnering regional and international support to regain the trust in Aden port as a safe and sustainable trading hub.

The future of Aden as a hub port isn’t only linked to the decline of Hodeidah’s role but is also related to the extent the relevant parties are able to overcome security, institutional, and economic obstacles. If the given opportunity is capitalized upon Aden can turn into a point of balance in a turmoil-filled sea. It will be able to redraw the map of navigation and supply in Yemen as well as open a wider horizon for development and stability in South Yemen in particular and Yemen in general.